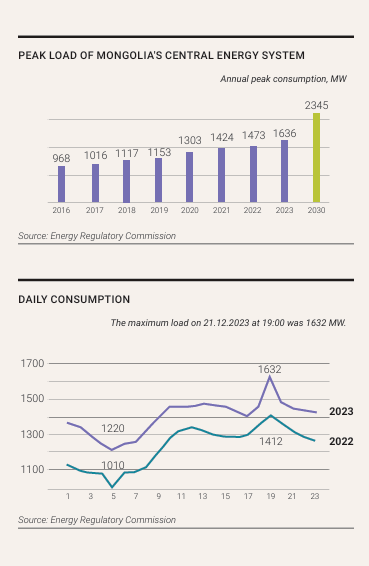

December 13 2023. "Russia has halved the amount of energy it supplies to Mongolia and announced that it will not be able to provide more than 150 MW of energy. Consequently, due to the risk of an energy shortage in Mongolia, certain restrictions on electricity consumption for consumers will take effect starting today," Energy Minister B. Choijilsuren stated. This issue emerged during the energy shortage in winter. The peak load reached 1,636 MW (1.6 GW) in that month, marking the highest consumption level in our history

In 2016, Mongolia used less than 1,000 MW of energy, but in December of last year, it was limited to 200 MW, and the peak load was maintained at 1,636 MW. Consequently, without reserve capacity, the power stations operated at full capacity throughout the winter without failure. Currently, Ulaanbaatar alone consumes 1,058 MW, indicating the capital's concentrated economic activity.

However, the total installed capacity of the country is 1,569 MW, meaning we are consuming more energy than we produce. Our country supplies 77.7 percent of its energy consumption through domestic production and 22.3 percent through imports from Russia and China. Considering that the energy sourced from China (66 percent to Oyu Tolgoi) is used in certain mines in the southern region and ports, Russian imports play a dominant role in our energy system. But why is there such a heavy dependence on Russian energy despite the relatively small import volume?

As illustrated in the graph, daily energy consumption fluctuates between 1,220 and 1,632 MW during peak winter loads. Mongolia adjusts this fluctuation with the help of Russian energy, which is the primary reason for our reliance on the northern neighbor. More than the "influence" of the Russians, this dependence is related to Mongolia's lack of its own resources to stabilize its energy regime.

As illustrated in the graph, daily energy consumption fluctuates between 1,220 and 1,632 MW during peak winter loads. Mongolia adjusts this fluctuation with the help of Russian energy, which is the primary reason for our reliance on the northern neighbor. More than the "influence" of the Russians, this dependence is related to Mongolia's lack of its own resources to stabilize its energy regime.

IRREGULARITY: 1 Percent of the Mongolian System is a Mode Adjustment Source

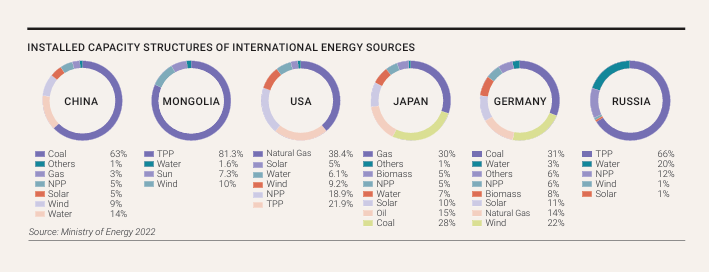

Depending on the distribution of settlements and infrastructure development in Mongolia, the energy system is divided into four regions: Western, Central, Eastern, and Altai-Uliastai. Of the domestic production, 80.6 percent comes from thermal power plants, 18.8 percent from renewable energy sources (9.9 percent from wind, 7.3 percent from solar, and 1.6 percent from hydropower), and 0.6 percent from diesel sources. According to industry experts, 20-40 percent of the total installed capacity of Mongolia's energy system should be maneuverable, and the total installed capacity should be at least 20 percent higher than the peak consumption.

Given the current peak load of 1,636 MW, the installed capacity should be 2,000 MW. Consequently, the sector is operating beyond its capacity. The most significant risk is that Mongolia's total energy production relies heavily on coal technology and unstable renewable energy stations. Only 1 percent comes from hydropower, a source capable of rapid maneuverability for mode adjustment. This highlights the irregularities within Mongolia's energy system. As a result, the transition to clean energy and the development of solar and wind stations remain uncoordinated, leading to increased reliance on imports. The failure to expand our energy sources in anticipation of future needs has resulted in today's energy shortage, increased import dependence, and a major bottleneck in development.

BASIC MODE SOURCES: TPPs and NPPs are Widely Used Worldwide

In basic mode, coal-based thermal power plants (TPPs) and nuclear power plants (NPPs) are widely used worldwide. Generating energy by firing one furnace of a coal-fired thermal power plant takes 4-5 hours, and once the plant is operational, the reaction cannot be stopped, making it impossible to quickly adjust production levels. Therefore, operating in basic mode provides a fixed and consistent level of energy output. In the past 10 years, the installed capacity of the world's thermal power plants has doubled.

Countries aim to maximize the use of the lowest-cost base-mode sources of energy. Apart from China, among the 32 countries with coal power projects, India, Laos, Nigeria, Pakistan, and Russia are each building one plant, while Indonesia is building three. China, the world's largest energy consumer and producer, has an installed capacity of 2,920 GW. Over the past 9 years, China has nearly tripled its energy capacity, with its GDP growing at a similar rate. It leads in both the number and capacity of TPPs. However, China is still unable to meet the ever-increasing domestic electricity needs of its large markets, industries, and regions.

Major industrial states began facing energy shortages two years ago. China's peak loads tend to occur in the summer, when heavy use of air conditioners and other cooling equipment increases electricity demand. In 2023, the summer peak load reached 281 GW per day, and the country consumed 9,220 TWh of energy during the year. "Coal power is China's ultimate guarantee of supply, particularly as hydropower production declines due to drought and low rainfall, and power generation from renewable sources is insufficient," said Yuan Jiahai, a professor at North China Energy University. According to Global Energy Monitor, 47 GW of new coal-fired power plants were put into operation in China last year, with CNY 1.5 trillion invested in this development. In 2022, a new 106 GW coal power production license was granted. Currently, 1,142 coal-fired power plants are operating in China.

However, China is still unable to meet the ever-increasing domestic electricity needs of its large markets, industries, and regions. Major industrial states began facing energy shortages two years ago. China's peak loads tend to occur in the summer, when heavy use of air conditioners and other cooling equipment increases electricity demand. In 2023, the summer peak load reached 281 GW per day, and the country consumed 9,220 TWh of energy during the year. "Coal power is China's ultimate guarantee of supply, particularly as hydropower production declines due to drought and low rainfall, and power generation from renewable sources is insufficient," said Yuan Jiahai, a professor at North China Energy University. According to Global Energy Monitor, 47 GW of new coal-fired power plants were put into operation in China last year, with CNY 1.5 trillion invested in this development. In 2022, a new 106 GW coal power production license was granted. Currently, 1,142 coal-fired power plants are operating in China.

However, for China, which has committed to net zero emissions, nuclear and renewable energy sources are increasing year by year. Two years ago, the country's installed nuclear power capacity was 54 GW. The construction of nuclear power plants, which will increase capacity by 26 GW, is underway and is expected to be fully operational by 2028. The tendency to abandon coal in the transition to clean energy varies depending on the level of development of countries. Due to the shrinking investment and financing of "brown" projects, nuclear power plants have been included in the "green" category in many countries. The advantage of nuclear power plants is that they emit very little CO2. Nigeria, rich in oil reserves and one of the ten largest uranium reserves in the world, has difficult access to electricity and is still heavily dependent on imports. Some countries with high development of renewable energy are operating hydroelectric plants in base mode.

The current capacity of Mongolia's base mode source, or TPP, is less than 1 GW. In Mongolia, which has an extreme climate, the cold season lasts nine months a year, and household consumption dominates the consumption structure. Over the last 80 years, coal-burning thermal power plants have been developed. Based on this, our system works in parallel with the Buryatia power system of Russia, which still sets the mode. Since the first furnace of TPP-4 was put into operation in 1983, no new sources have been built in Mongolia, except in the private sector. Only the equipment has been updated, and the stations have been expanded.

Policy documents and government action programs have periodically included, and are still discussing, the construction of large stations such as Ulaanbaatar TPP 5, Oyu Tolgoi, Tavan Tolgoi, Baganuur, and Shivee-Ovoo. In 2015, a contract was negotiated with the Chinese state-owned "State Grid Corporation of China" for the construction of a 5,280 MW export-oriented power complex based on the Shivee-Ovoo field. However, today, we import electricity from China for our mines, industries, and border ports. The Oyu Tolgoi imports energy worth USD 150-200 million per year. From 2013 to 2017, when the proposal for the construction of the Tavan Tolgoi station was developed and discussed with the Mongolian side by the Rio Tinto group, which implements the project, the government changed three times, and the decisions kept changing each time. Finally, it was decided to build a 450 MW plant with the investment of a state-owned company and put it into operation in 2024.

In February of this year, during the "Energy for Regional Development" discussion, N. Tavinbekh, State Secretary of the Ministry of Energy, addressed the issue of funding challenges for coal technology-based energy sources. "Three tenders for financing the Tavantolgoi TPP were announced, but all were unsuccessful," he noted, highlighting the current reliance on government and domestic funding to determine future large-scale power sources.

As the mining and processing industries expand, so does the demand and consumption within our country. However, estimates suggest that it takes 5-10 years to complete a TPP project from feasibility studies to fundraising and construction. A notable example is the 300 MW thermal power plant project in Buuruljuut, which, after 10 years of private investment, is now ready for operation.

Conversely, there are opportunities to attract investment from Western countries for non-coal energy sources. Nuclear power remains a contentious topic in Mongolia. Last year, during the COP 28 meeting, 22 countries signed a declaration advocating for a tripling of nuclear energy by 2050. Mongolia, one of the five countries without nuclear power, is currently collaborating with the French "Orano" group to implement the "Zuuvch Ovoo" uranium project in our country.

MODE ADJUSTMENT SOURCES: Globally, HPPs are the Most Common

Energy must be consumed at the moment it is produced. Therefore, sources and reserve accumulators capable of adjusting and maneuvering in response to demand fluctuations are activated. The ability to maneuver is measured in seconds, allowing resources that can ramp up or down energy production to manage load changes.

These resources include hydro, gas, and storage power plants. Mongolia, lacking these resources, regulates peak load fluctuations through energy imported from Russia. Among these highly maneuverable resources, hydroelectric power is the most prevalent globally. With a total installed capacity exceeding 390 GW from over 300 hydroelectric dams, China leads, followed by Brazil, the United States, Canada, and Russia. Four of the world's six largest dams are located in these countries, with the "Three Gorges Dam" on the Yangtze River alone contributing 15 percent of China's energy with a capacity of 22,500 MW. Three years ago, after heavy rains, this colossal station set a world record by generating 112 TWh of electricity.

Brazil identified the energy sector as pivotal for economic expansion and heavily developed hydropower in the 1970s, increasing its total energy production tenfold by 2010, with 88% of consumption met by hydropower. In 2022, the world's installed hydropower capacity will surpass 1,200 GW for the first time, with construction investments reaching USD 36 billion. Hydroelectric power accounts for 37% of electricity and energy production in the European Union, playing a crucial role in stabilizing fluctuations from solar and wind stations. International researchers emphasize that hydroelectric power will remain significant as the influence of Russian natural gas supply declines.

According to an IEA study, Central Asian countries with arid climates are expected to attract increased investment in hydropower in the coming years. Hydropower offers the highest electricity production among renewable technologies. In Congo, rich in vital metals like cobalt and copper, and abundant in resources such as oil, natural gas, uranium, biomass, solar, wind, water, and geothermal energy, only 9% of the population has access to electricity. Ethiopia, one of Africa's fastest-growing nations with an average growth rate of 10% since 2005, ranks second in Africa with 45,000 MW of hydroelectric potential. However, only 1% of its energy comes from hydroelectric plants, with more than 90% from waste and biomass. Ethiopia is often referred to as the "water tower of East Africa" due to its significant share of the Nile's water, holding about 86% of it alone. Meanwhile, Norway relies on 937 hydroelectric plants to supply 98% of its energy, demonstrating a clear reliance on leveraging natural advantages through policy and solutions.

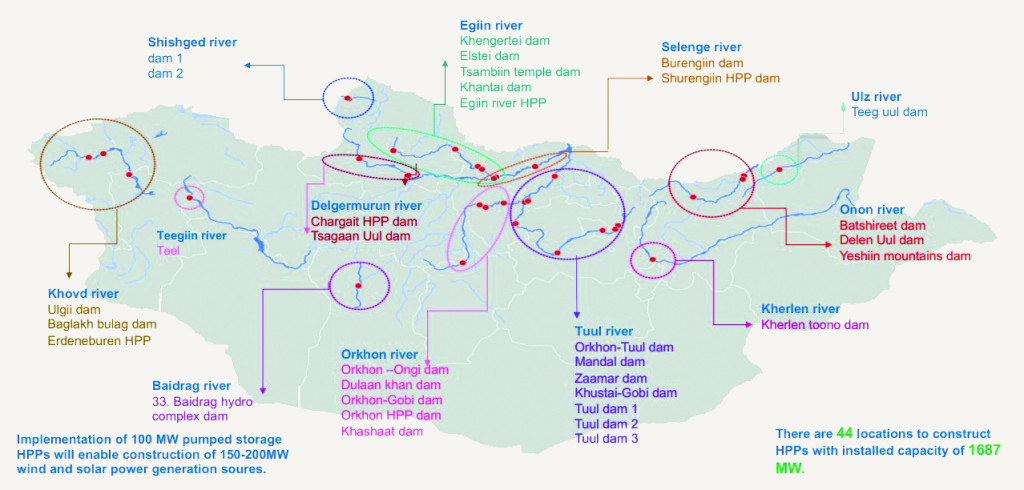

Experts believe that HPP represents the most suitable resource for Mongolia to reduce its import dependence in line with the global shift towards clean energy. In 2008, the Durgun and Taishir low-power hydroelectric power plants were commissioned, marking a significant milestone for hydroelectric power in Mongolia. These plants, with a combined capacity of 23 MW, constitute 1.6 percent of Mongolia's energy system. Concerns about Russian influence in maintaining Mongolia's import dependence have been raised, notably with projects like the Eg River HPP, a topic discussed by some of our ministers and leaders. Rather than focusing on projects involving interstate border issues, there is an opportunity to develop domestically relevant HPPs, establishing small and medium-sized stations on inland rivers.

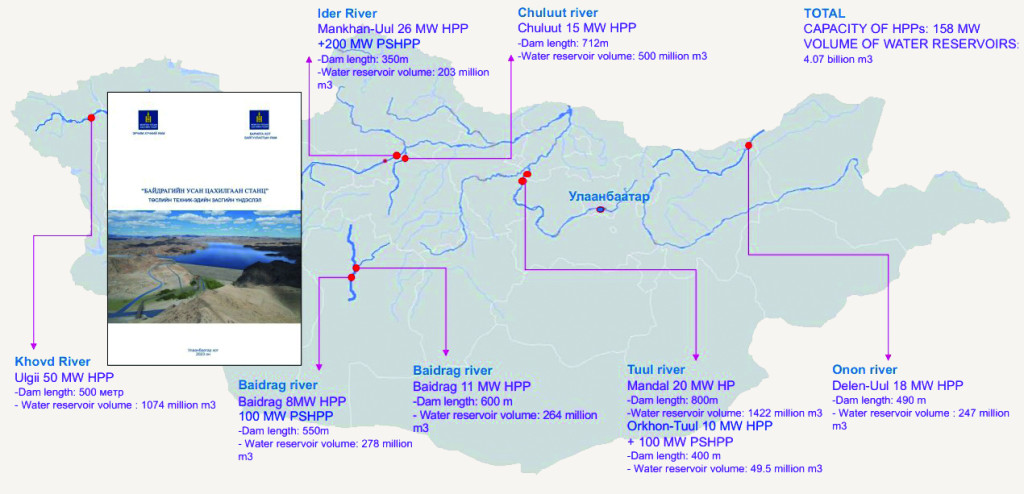

According to the Ministry of Energy study, there is potential to develop HPPs with a total installed capacity of 1,687 MW across 44 locations. Progress is underway, albeit with local opposition affecting projects such as the 90 MW Erdeneburen HPP, where 95 percent of the USD 270 million budget was financed through a concessional loan from the Export-Import Bank of China (EXIM), with construction intensifying this year. Meanwhile, financing for the 30 MW Baidrag HPP project has gained favor from Hungary. A feasibility study for a 100 MW water storage plant near the Yeruu River in Selenge province has also been completed, with plans for implementation starting in 2025 using a USD 150 million loan from the Asian Development Bank.

HPP serves as a form of energy storage technology. The global installed capacity of pumped storage hydropower reached 139.9 GW last year, up from 100 GW a decade ago. This technology is widely employed in Southeast Asia and China. For instance, a hydropower plant in Japan, which created an artificial lake in the mountains 50 km from Tokyo, swiftly activated its generators for mode adjustment. Similarly, plans are underway to build an artificial lake in the Terelj Basin atop a mountain, using floodwaters from the Tuul River during summer to generate hydroelectric power. Economist N. Enkhbayar has discussed its potential for use during winter peaks. Mongolia has significant potential to collaborate on HPP technology with Japan, a G7 member and close partner.

In recent years, the rapid development and global adoption of rechargeable batteries have emerged as a pivotal mode adjustment resource. These batteries store energy during periods of low consumption and release it during peak loads, making them a significant tool in reducing Mongolia's reliance on energy imports from Russia. The IEA projects that global investment in rechargeable batteries will soar to over USD 120 billion by 2030, up from USD 5 billion previously. By then, the world's total energy storage capacity is expected to increase sixfold, with batteries accounting for 90 percent and the remainder from hydroelectric power stations. The IEA's recent "Battery and Secure Energy Transition Report" forecasts a doubling in the use of rechargeable batteries in the energy sector by 2023 compared to the previous year. China, currently the largest market for batteries, consumes more than half of the batteries used worldwide in the energy industry.

Towards the end of last year, Mongolia commissioned a new battery storage station capable of supplying up to 80 MW of power during peak loads. Additionally, an international open tender was recently announced to select a company to construct a 50 MW battery storage plant in the Baganuur district. While this technology offers the advantage of rapid deployment, with stations built within a short timeframe, it also comes with a lifespan of 10-15 years. Some experts caution that it represents a costly and short-term solution for Mongolia.

Industry researchers suggest that gas power plants (GPPs) are suitable for the provinces and districts of our country with dispersed settlements and lower energy demands. These mode adjustment sources can be assembled and operational within a year. However, there are concerns about renewed dependence on imported gas, potentially from neighboring countries. Building such stations could lead to multiple sources of gas imports, not only from Russia but also from China and Kazakhstan.

Alternatively, Mongolia possesses coal bed methane (CBM) gas reserves. Currently, six projects with Production Sharing Agreement (PSA) contracts are underway, including involvement from four Australian companies. Moreover, numerous CBM projects have commenced drilling operations in Mongolia, aiming to create favorable conditions for development. From 2001 to 2022, countries like Japan, the United States, and France collectively accounted for 60 percent of global investments in gas energy production, with Japan emerging as a dominant player in this market. During this period, the world's eight largest banks invested USD 17 billion in gas power plant projects.

RENEWABLE ENERGY SOURCES: The development of solar and wind farms hinges on mode adjustment capabilities

The global emphasis on combating climate change has heightened the importance of clean energy. As nations prioritize technologies with low greenhouse gas emissions and as these technologies become more affordable, the rapid expansion of renewable energy production is gaining momentum. Solar and wind farms, however, are reliant on natural conditions and lack control over production, earning them the label of variable sources. Production ceases on cloudy or windless days, underscoring the need for capacity in maneuverable resources to compensate for these fluctuations. Thus, the development of solar and wind energy production is directly tied to a country's installed capacity of maneuverable resources.

Germany, for instance, can fulfill 100% of its solar and wind energy consumption on certain days due to an installed capacity that exceeds demand by 2-3 times. As Europe's largest energy consumer, Germany is committed to a long-term initiative known as Energiewende, aimed at transitioning to a low-carbon and more efficient energy mix. This initiative includes goals to phase out coal and nuclear power gradually while expanding renewable energy. By 2028, Germany aims to derive 65% of its total consumption from renewable sources. Among the 40 countries generating at least half of their energy from renewables, 11 are in Europe. Norway stands out as the world's largest producer of clean energy, with 98.5% of its energy coming from renewable hydro sources. Only Costa Rica matches this achievement, operating nearly 300 days a year solely on renewable energy.

China, on the other hand, has been rapidly deploying several gigawatts (GW) of solar and wind farms annually. As of March this year, China's renewable energy capacity reached 1,585 GW, a 26% increase from the previous year. The IEA forecasts that China will continue leading the expansion of renewable energy, with estimates suggesting a further increase to 59% by 2028.

In Mongolia, nine private sector solar and wind stations with a combined 245 MW of variable mode adjustment capacity are currently operational, supported by energy imports from Russia. Mongolia enacted the Law on Renewable Energy in 2007 to prioritize renewable energy development and attract investors. Under this law, tariffs for solar, wind, and hydro resources are denominated in US dollars to stabilize investments.

Since the law's adoption, from 2008 to 2018, 39 entities have been granted special permits to construct renewable energy sources totaling 1,352 MW, equivalent to Mongolia's entire installed energy capacity. Despite these permits, Mongolia currently lacks the technical infrastructure to absorb such power. Over 10 licenses, including those involving international investors, are currently under litigation, with five licenses revoked. This underscores Mongolia's initial oversight in calculating domestic energy and infrastructure capacities when issuing initial permits for renewable energy projects.

Some companies advocate that building 1-2 large renewable energy plants to export energy to China could yield greater profits than coal. Foreign investors are also expressing interest in such ventures, highlighting potential opportunities for collaboration in this direction.

Energy Insight Magazine, №02, 03 (003, 004)